9: Systemic Risk Management

Do you think failure of one systemic organization can result in failure of complete system. Let's find out further the topic systemic risk management and see some best case examples.

Systemic Risk is defined as :

A risk of disruption to financial services that is caused by an impairment of all or parts of the financial system and can have serious negative consequences for the economy.

Systemic risks result from large-scale weakening or collapse of systems upon which the economy and society depends.

This includes:

- Financial systems (E.g. increase liability on books, loss to financial assets )

- Natural resource systems

- Technological systems (E.g. Cyber attacks, downtime, breach )

It addresses the mechanisms a company has in place to reduce its contributions to systemic risks and to improve safeguards that may mitigate the impacts of systemic failure. For financial institutions, it captures the company’s ability to absorb shocks rising from financial and economic stress and meet stricter statute requirements related to the complex and interconnectedness of companies in the industry.

The most important feature of systemic risk is that the risk spreads from unhealthy institutions to relatively healthier institutions through a transmission mechanism.

Interconnectedness in Systemic Risk

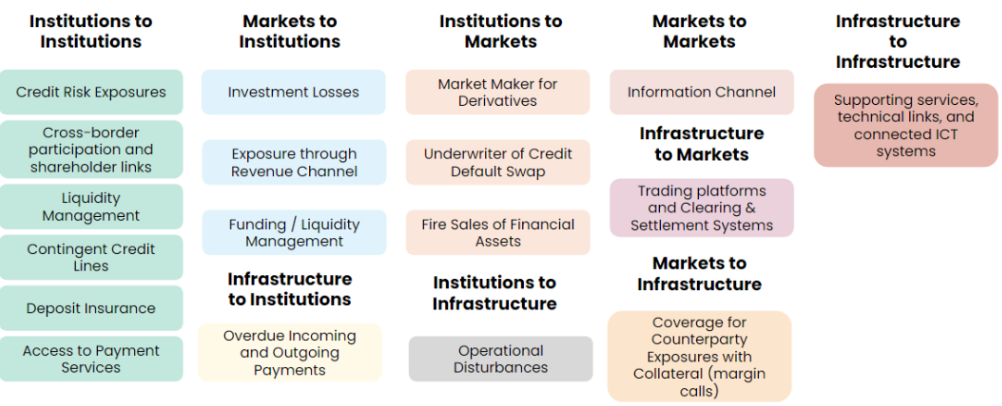

The interconnections ‘within the financial system’ and ‘from the financial system to the real economy’ give contagion effects that are likely to occur in the event of a financial crisis. Below is the contagion mapping which provides authorities an overview of the main interdependencies in the financial system. This enables them to make a quick assessment of the shocks that are to be absorbed.

Best Practices to reduce Systemic Risks

1. More or better Capital/ Liquidity

Firms contributing to systemic risk should focus on reducing the externalities they create. Capital and liquidity buffers at higher levels across the hierarchy is one way to do so.

2. Resolution Regime

Adequate resolution regimes should be formulated for prevention of system wide loss in case of institutional failure. This can be prevented by avoiding the sheltering of key counter parties from loss due to such failures, so that credibility is maintained for all parties involved.

3. Structure of the financial industry

In the wake of financial crises that have happened over the time, actions are to be taken to avoid usage of incentives that promote inconsistent leverage and short term profit. One such approach is to cap the size/ structure of financial institutions and their business activities. Though there are always diverse approaches to business for different financial bodies and circumstances, all standards and measures should ensure systemic risk is reduced and the playing field is level for all.

4. Robust market infrastructure

A major way to reduce systemic risk is to create a resilient market structure, such as trading of financial derivatives only on regulated exchanges. Another way can be to replace bilateral exposures with central counterparties, which can act as a buffer against transaction risk.

5. Enhanced Supervision

Enhancing the supervision of financial institutions is required to maintain the business related activities of such institutions in the purview of regulations as well as to know if they are working under the regulation or not.

6. Imposing fiscal buffers

Fiscal policies can be put in place to reduce systemic risk, one such way being fiscal automatic stabilizers playing their part in difficult times. Government can act as an insurer by building fiscal room for a good economic situation and as stabilizing reserves during an economic downturn.

A Case Approach

A well known example of systemic risk is the 2008 financial crisis, where the collapse of the US housing market and the failure of several large financial institutions led to a global financial crisis. A large number of financial firms failed or were rescued by the government or acquired in distress. The US government intervened in the financial market through a number of steps to address the widespread financial disruption.

The government created emergency programs targeting frozen or disfunctional financial markets. The US government also passed an policy ( Emergency Economic Stabilization Act ( EESA) implemented to inject capital into numerous small banks and large financial firms. The funds under EESA were further used to assist industries such as automakers.

The way the Swedish government handled the financial crisis of 2008 is another great illustration of effective systemic risk management. Swedish authorities implemented steps like nationalizing insolvent banks, recapitalizing powerful institutions, and ensuring depositors' accounts as a proactive response to the crisis. These actions assisted in stabilizing the financial system and containing the crisis. The Swedish government's approach to addressing systemic risks has received high recognition and is seen as a model by other nations.